The European Commission chief, Jean-Claude Juncker, has said he feels "betrayed" by the "egotism" shown by Greece in failed debt talks.

He told a news conference that Greek proposals were "delayed" or "deliberately altered" and the Greek people "should be told the truth", but the door was still open to talks.

Greece has called a surprise referendum and Greek banks are closed for a week.

European stock markets saw big falls on Monday after the weekend's events.

The negotiations were not "a game of liar's poker", Mr Juncker said. "Either all win or all lose".

He said the talks were broken "unilaterally" by the announcement from the Greek Prime Minister Alexis Tsipras that he was calling a referendum for 5 July.

The Greek government responded to Mr Juncker's comments by saying: "An essential element in indicating good faith and reliability in negotiations is sincerity."

Mr Juncker said that he still believed a Greek exit from the euro was not an option and insisted that the creditors' latest proposal meant more social fairness.

German Chancellor Angela Merkel echoed those comments on Monday, saying Greece had received a "generous offer" but adding she would not be opposed to further talks with Greece after Sunday's vote, Reuters reports.

Analysis by the BBC's Chris Morris

It's hard to remember the last time a president of the European Commission used such blunt, undiplomatic and sometimes angry language about the government of a member state.

Jean-Claude Juncker said he felt betrayed, and suggested that Alexis Tsipras was lying to his people about cuts in wages and pensions.

There was no hint of a last minute deal before Greece's current bailout programme expires Tuesday evening.

Instead Mr Juncker appealed directly to the Greek people ahead of the proposed referendum this weekend.

And the message was clear - vote "yes" to our proposals and we'll support you. Vote "no" and you'll probably get kicked out of the euro.

Mr Juncker also said any criticism aimed at him or other senior politicians in the creditor institutions was unjustified.

It was an emotional appeal from the heart.

But it also felt like a pre-emptive effort to make his side of the story public in case this all goes very wrong.

On Saturday, the European Central Bank (ECB) decided not to extend emergency finance to the Greek banks, after the breakdown of talks on giving heavily indebted Greece the last payment of its international bailout.

Following the ECB announcement, Greece said its banks would remain shut until 6 July. Cash machines are now reopening, but customers can withdraw only limited amounts.

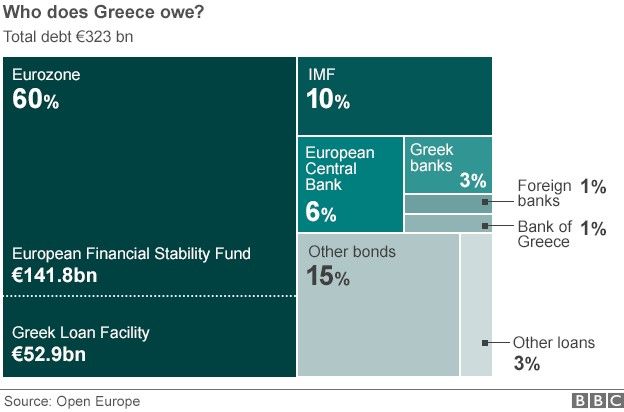

A critical deadline looms on Tuesday, when Greece is due to pay back €1.6bn to the International Monetary Fund - the same day the bailout expires. There are fears of a default and a possible exit from euro.

The French cabinet met on Monday in an emergency session. President Francois Hollande said afterwards that a deal was still possible if the Greeks wanted it.

"There are a few hours before the negotiation is definitively closed, in particular for the prolongation of the Greek aid programme."

'Resorting to barter system'

Athens resident Ilia Iatrou says the situation is "unbearable".

"My mother-in-law queued up for over an hour at the cash point just to be able to withdraw a small amount of money.

"I haven't tried to go to the cash machine myself, as we don't have much money left.

"My neighbours and I have now resorted to a sort of barter system among ourselves because we have no money left.

"We can't take any more of this, so we have to keep saying no to the EU masters.

"The EU can't afford to let us fail so we should continue to say no and they will blink and give us a better deal."

In its decree bringing in the bank restrictions, the Greek government cited the "extremely urgent" need to protect the financial system due to the lack of liquidity.

The main points are:

- Banks closed till 6 July

- Cash withdrawals limited to €60 (£42; $66) a day for this period

- Cash machine withdrawals with foreign bank cards permitted

- Pension payments not part of capital controls

- Banking transactions within Greece allowed

In reaction to the crisis, the London, Paris, Frankfurt and Milan stock markets fell sharply in early trading on Monday, following similar falls in Asia.

The euro lost 2% of its value against the the US dollar. Government borrowing costs in Italy and Spain, two of the eurozone's weaker economies, have also risen.

The Athens stock exchange is also closed as part of the measures.

Days of turmoil

- Friday evening: Greek prime minister calls referendum on terms of new bailout deal, asks for extension of existing bailout

- Saturday afternoon: Eurozone finance ministers refuse to extend existing bailout beyond Tuesday

- Saturday evening: Greek parliament backs referendum for 5 July

- Sunday afternoon: ECB says it is not increasing emergency assistance to Greece

- Sunday evening: Greek government says banks to be closed for the week and cash withdrawals restricted to €60

Eurozone finance ministers also blamed Greece for breaking off the talks, and the European Commission took the unusual step on Sunday of publishing proposals by European creditors that it said were on the table at the time.

But Greece described creditors' terms as "not viable".

The current ceiling for the ECB's emergency funding - Emergency Liquidity Assistance (ELA) - is €89bn (£63bn). It is thought that virtually all that money has been disbursed.