Don’t write off half of the world economy

Opportunities in emerging markets

Author: Yael Selfin, Head of Macroeconomics, KPMG

Emerging markets appear to be less in vogue than they once were. The end of the commodities super cycle, a turn in US monetary policy, and a challenging economic transition in China, have all conjured doubts about the prospects for emerging economies.

Faith was particularly dented in those countries that committed one of the four ‘sins’:

• large current account deficit

• high level of dollar denominated debt

• strong dependency on commodity exports; and

• significant exports exposure to China.

After a difficult year in 2015, emerging market and developing economies should breathe a sigh of relief, the worst may be over for many. Some countries will do better than others, while low asset prices and falling exchange rates may offer investors good opportunities.

In the short term, countries with current account surplus, or a relatively modest current account deficit, such as the Philippines, India, and Thailand could see their currencies remain relatively stable. As the value of the US dollar rises, India, and to a lesser extent South Africa, should also benefit from the fact that a smaller proportion of their debt would be adversely affected.

Countries with a diverse export base, in terms of both product and geographical market, should be more resilient. This is the time for those countries that developed export industries beyond commodities to shine. Although not all commodity exporters are likely to be impacted, those linked to China’s manufacturing and real estate sectors are more vulnerable, others could see opportunities in some of the growth markets.

Those economies that are less exposed to China, and to its declining industries in particular, could be of interest. Poland and Kenya come to mind. It is important to distinguish, however, between exposure to different parts of the Chinese economy, as a growing focus on consumption should provide opportunities for a wide variety of exports.

Beyond the immediate future, fundamentals also count. Our analysis shows that the strength of public institutions could make a significant impact on countries’ growth potential, and strong public institutions can steer countries to a solid economic path in adverse time.

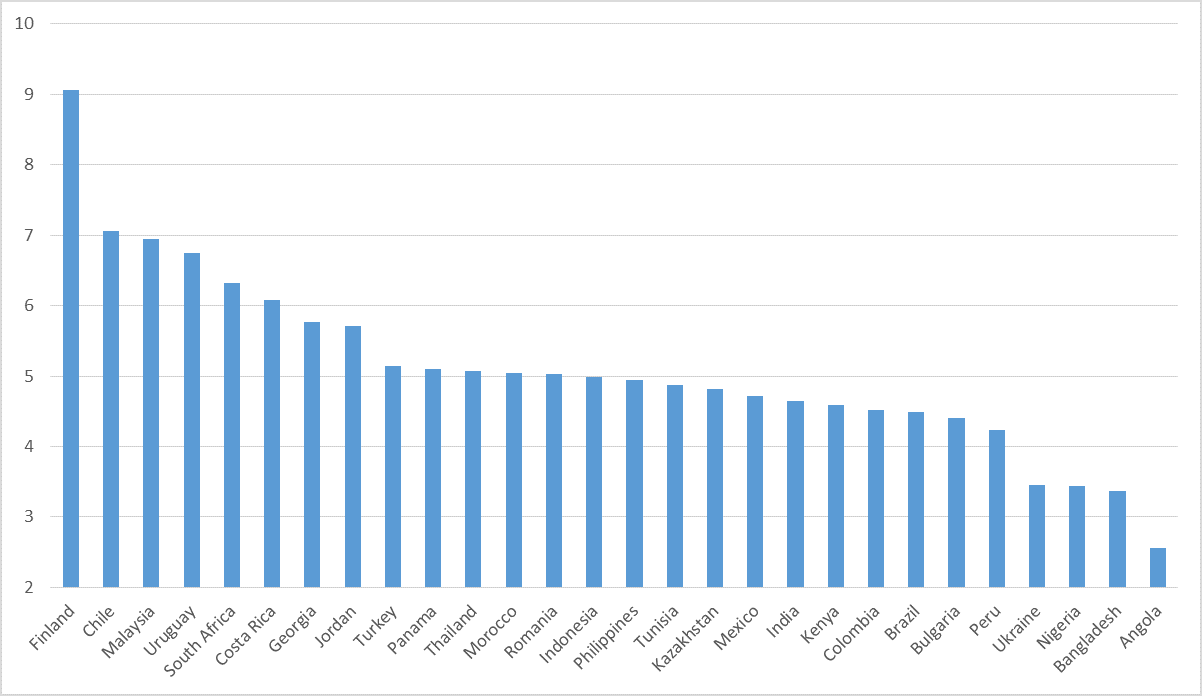

Our latest Variables for Sustainable Growth Index shows how diverse emerging markets performance is in this area (see chart below). Countries like Chile and Malaysia perform particularly well, followed by Uruguay, South Africa and Costa Rica.

For an example of why it matters, take Nigeria, a country that has been significantly hurt by the falling oil price. Our analysis shows that if Nigeria could get its institutional strength to reach the level of Finland, its economic growth would be consistently higher, causing GDP per capita to be over 30% higher by 2050. To do that, Nigeria will need to continue tackling corruption, raise government effectiveness and improve regulatory quality and judicial independence.

VSG’s Institution strength pillar, selected countries performance, 2015

Source: KPMG Macroeconomics analysis based on data from World Bank and WEF .

The lesson for investors, business leaders and policy makers is to take a wider view of emerging economies when searching for opportunities for growth. Almost every country will have its hidden gem waiting to be explored, so it is worth taking the time to discover what these are and how they best might be leveraged.