Blog Post

The Fed’s New Dollar Token Policy, and Why It Matters

Bretton Woods Committee

|

Wed, Sep 6, 2023

by

Barbara C. Matthews

Body

A version of these remarks was delivered at the 5th Annual Cryptocurrency and Blockchain Summit held in Cambridge, UK on 7 September 2023 as part of the panel presentation: “The Future of Money – Stablecoins v. Central Bank Digital Currencies”

Within 48 hours in August 2023, a major US payments provider (PayPal) announced plans to issue a stablecoin and the Federal Reserve provided a framework to facilitate issuance of stablecoin dollar tokens by banks. By the end of the month, the House Financial Services Committee had objected to the new policy on the grounds that the Fed was creating new hurdles for bank stablecoin issuance. The moves occur as European policymakers prepare to endorse the next phase of development for a digital euro later this year.

We thus ended the summer with formal written Federal Reserve guidance that, at least on paper, supports bank issuance of dollar tokens. The move marks a material shift in the Fed’s formal approach regarding at least stablecoins. Having spent much of 2023 with the opposite starting point, at least some in the industry will welcome the move made by the Fed in early August. The move was not without controversy, however. The Chairman of the House Financial Services Committee has lodged a written complaint, asserting that the new Federal Reserve policy creates new hurdles for bank cryptocurrency activities.

This essay does not take a position in the intensifying Federal Reserve vs. Congress controversy. Instead, this article argues that even if Chairman McHenry is right and the Fed seeks surreptitiously to continue constraining bank cryptocurrency activities, the broader macro context will require the Fed to embrace bank issuance of dollar tokens in the coming months.

BACKGROUND

The Federal Reserve began 2023 hostile to the cryptocurrency sector. In both January and February, supervisory letters told banks that providing crypto intermediation services was presumptively an “unsafe and unsound banking practice.” The starting position was to disallow the activities. Many still believe the initiative constrained liquidity to the sector, accelerating the demise of Silicon Valley Bank and Signature Bank.

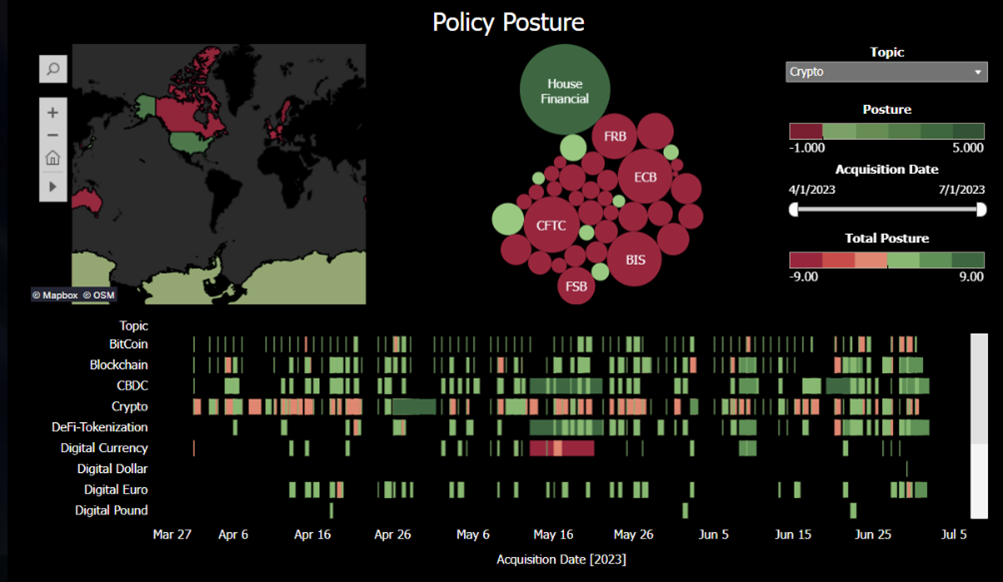

Throughout early summer, the House Financial Services Committee stood nearly alone globally as the Republican-led House of Representatives tried to craft a more friendly, predictable policy environment in part to ensure that the center of gravity for blockchain-based intermediation did not shift abroad:

Data: BCMstrategy, Inc.

During the last week of July, the House Financial Services Committee passed seven pieces of legislation designed to facilitate stablecoin regulation at the state level while prohibiting the Federal Reserve from taking action.

Less than two weeks later, PayPal (a state-regulated money transmitter, not a bank subject to Federal Reserve supervision) announced plans to launch a dollar-based stablecoin (August 7) and the Federal Reserve announced a friendly framework for firms to issue “dollar tokens” (August 8).

THE FED’S NEW DOLLAR TOKEN POLICY

Specifically, the Federal Reserve now has a formal “nonobjection process” regarding stablecoin issuance by banks. Federal Reserve supervisors will approve bank applications to “use distributed ledger technology or similar technologies to conduct payments activities as principal, including by issuing, holding, or transacting in dollar tokens.” It is a stunning shift in stance compared to the January and February statements.

Preconditions exist to qualify for the nonobjection process. Authorization hinges on the bank being able to show implementation of appropriate, specific, and familiar risk management protocols. The most important gateway condition involves familiar “know your customer” rules to insulate the bank from unwittingly facilitating illicit transactions.

The Federal Reserve in parallel created a new oversight framework designed to supervise “novel activities” by banks. Specifically, the new supervisory framework “will focus on novel activities related to crypto-assets, distributed ledger technology (DLT), and complex, technology-driven partnerships with nonbanks to deliver financial services to customers.” The initiative reflects the Fed’s own stunning admission earlier this year that its supervisors had not fully understood Silicon Valley Bank’s business model.

The new pair of policies drew criticism from the House Financial Services Committee on the grounds that they undermine the legislation passed by the Committee at the end of July. Members of Congress assert that the new standards “provide the Fed with additional tools to deny crypto-asset related activities…(and) will ultimately lead to a de facto prohibition on banks engaging with the digital asset ecosystem,“ particularly with respect to public, permissionless blockchains. Legal challenges may also be brewing, as the Members of Congress object to the fact that the new policy was implemented without the required notice of comment in advance of a rulemaking.

THREE REASONS WHY IT MATTERS

Many may view the Congressional/Federal Reserve drama as yet another example of petty partisan political bickering in the United States. This would be a mistake. The landscape for cross-border payments and reserve currency dynamics are shifting before our eyes. It matters for three important reasons.

1. The Future of Banking is on the Line (and on the Blockchain)

The most recent Federal Reserve survey data (Economic Well-being of US Households, 2022) indicates that at least 12% of the U.S. population currently holds cryptocurrency. Coinbase data from February 2023 estimates that cryptocurrency ownership rates are nearly double (20%) the Fed’s estimates despite the frauds and insolvencies in the sector last year. Most experts expect usage rates to increase.

In other words: creating hurdles for bank stablecoin issuance would push a large and growing amount of intermediation business outside of the regulated banking sector.

Banks would lose the capacity to compete for customer business at a point in time when deposit outflows continue to increase. A growing number of consumers may choose to hold uninusured deposit-like balances at money transmitters like PayPal rather that at commercial banks. The amounts are not small. As House Financial Services Committee Ranking Member Waters noted in her statement on the PayPal stablecoin, PayPal has 435 million customers globally, which “exceeds the number of online accounts at all of the megabanks combined,” potentially raising both consumer protections and financial stability concerns in her view.

If the Federal Reserve has any hope of exerting influence and control over the digital dollar market, it has every incentive to accelerate the capacity for commercial banks to compete with state-regulated money transmitters like PayPal. Creating roadblocks for banks in this space effectively cedes important intermediation businesses to non-banks.

2. Global Role of the USD, Retail Edition

The stablecoin market currently is a de facto dollar token market. The overwhelming majority of stablecoins are tied to the US dollar.

Globally, consumers interested in experimenting with cryptocurrency issuance in a cautious manner choose coins backed 1:1 with the US Dollar. It is not clear what percentage of these users also seek access to the US dollar for a range of illicit or inappropriate uses. But this is true also for the cash version of the currency.

The new PayPal stablecoin (the PYUSD) will create a mechanism to convert ANY cryptocurrency into dollar tokens redeemable for US dollars.

In other words: retail users around the world continue to see the US dollar as a safe haven relative to their national currencies. PayPal will meet these consumers where they are and accelerate their access to US dollars in digital format.

Permitting US banks to issue their own dollar tokens would further embed reliance on the USD within the formal banking system. Some have recently also suggested in a WSJ opinion piece that expanded access to dollar-denominated stablecoins would solidify the USD’s global reserve currency status for another generation.

Whether continued retail reliance on an electronic dollar token occurs naturally or though legislative design, the Federal Reserve has every incentive to encourage US banks to issue stablecoins. Constraining retail access to the US dollar will create incentives for retail users to rely on non-dollar digital currencies…. like the forthcoming digital euro.

3. Global Role of the Dollar – Geopolitical Competition

History tells us that reserve currencies neither go quietly into the good night nor do the transitions occur slowly. The most recent shift occurred 100 years ago from the pound sterling to the US dollar. Recent research from eminent academics like Barry Eichengreen and Niall Ferguson as well as older books focused on sterling and the derivatives markets among others have chronicled how major geopolitical dislocations trigger volatility shifts in market support for the prevailing reserve currencies of their day.

Resistance to dollar dominance did not begin with Satoshi, BitCoin, and the Great Financial Crisis. Nor did it begin with the post 9-11 weaponization of the currency, much less the periodic debt ceiling dramas. In fact, resistance to dollar dominance began in France in the 1960s. Despite all the complaints about the US dollar’s dominance, the absence of realistic alternatives has largely relegated the complaints to idle talk.

Distributed ledgers change everything.

The proliferation of privately issued payment tokens and sovereign issued central bank digital currencies potentially create multiple alternatives to the US dollar that are immediately accessible globally. No individual currency needs to replace the US dollar for the US dollar to lose its role as the main reserve currency.

This is NOT a theoretical suggestion.

During the third week of August, researchers from the European Central Bank, the Hong Kong Monetary Authority, ASEAN + 3 (South Korea, Japan, China) and the Bank of Finland, gathered in Hong Kong to discuss the future of the international monetary system. It is not clear whether the Federal Reserve was present. Hong Kong Monetary Authority Chief Executive Yue expressly placed the reserve currency competition dynamic in sharp relief:

“Currently, the international monetary system is predominantly a US dollar-based system, and the euro is mainly playing a regional role. This system has been the foundation of globalisation of the world economy for several decades. However, with increasing geoeconomic fragmentation, to what extent will the world also move towards a more multipolar monetary system with different currency blocs?...Looking further ahead, a more pertinent question would be: How will the advancements of wholesale CBDCs speed up the use of local currencies in cross-border payments, thereby reducing the use of major reserve currencies?”

Nor is it an academic suggestion. The European Central Bank is widely expected to announce its plans to take the next step towards launching a digital euro this autumn. Policymakers have been publicly opining all year about the possibility that a digital euro could position the common currency for a larger global role.

A shift away from the US dollar as a global reserve currency will impose costs on the United States over time. It could easily increase prices as imports incorporate exchange rate risks and as the cost of transaction fees are passed on to end users. Political science and history suggest strongly that multipolar systems in general tend to be less stable than bipolar ones, with increased risks of volatility as different poles in the system compete with each other for advantage.

If the Fed values its role as steward of the U.S. dollar’s global role and its ability to provide financial stability when the situation arises, policymakers really have no other choice but to embrace dollar tokens and stablecoins. Between January 2023 and August 2023, its shift of stance on paper implicitly reflects this realization. Ironically, they agree with their foes on Capitol Hill on this point.

Failure to find consensus and continued public bickering on the road towards tokenization risks creating strategic opportunities for private and sovereign competitors to the US dollar. The next 18 months promise to be as interesting as the last 18 months.

Barbara C. Matthews is a non-resident Senior Fellow with the Atlantic Council. She is also the Founder and CEO of BCMstrategy, Inc., a data and technology company that measures public policy risks using patented technology. She was the first U.S. Treasury Attache to the European Union with the Senate-confirmed diplomatic rank of Minister-Counselor. She also served as Senior Counsel to the House Financial Services Committee. The views in this essay reflect her personal opinion. As a data and technology company, the BCMstrategy, Inc. team and board do not provide analysis or opinions regarding public policy developments.

To continue reading at

Bretton Woods Committee

, click here.

The Fed’s New Dollar Token Policy, and Why It Matters

Bretton Woods Committee | Wed, Sep 6, 2023

by Barbara C. Matthews

A version of these remarks was delivered at the 5th Annual Cryptocurrency and Blockchain Summit held in Cambridge, UK on 7 September 2023 as part of the panel presentation: “The Future of Money – Stablecoins v. Central Bank Digital Currencies”

Within 48 hours in August 2023, a major US payments provider (PayPal) announced plans to issue a stablecoin and the Federal Reserve provided a framework to facilitate issuance of stablecoin dollar tokens by banks. By the end of the month, the House Financial Services Committee had objected to the new policy on the grounds that the Fed was creating new hurdles for bank stablecoin issuance. The moves occur as European policymakers prepare to endorse the next phase of development for a digital euro later this year.

We thus ended the summer with formal written Federal Reserve guidance that, at least on paper, supports bank issuance of dollar tokens. The move marks a material shift in the Fed’s formal approach regarding at least stablecoins. Having spent much of 2023 with the opposite starting point, at least some in the industry will welcome the move made by the Fed in early August. The move was not without controversy, however. The Chairman of the House Financial Services Committee has lodged a written complaint, asserting that the new Federal Reserve policy creates new hurdles for bank cryptocurrency activities.

This essay does not take a position in the intensifying Federal Reserve vs. Congress controversy. Instead, this article argues that even if Chairman McHenry is right and the Fed seeks surreptitiously to continue constraining bank cryptocurrency activities, the broader macro context will require the Fed to embrace bank issuance of dollar tokens in the coming months.

BACKGROUND

The Federal Reserve began 2023 hostile to the cryptocurrency sector. In both January and February, supervisory letters told banks that providing crypto intermediation services was presumptively an “unsafe and unsound banking practice.” The starting position was to disallow the activities. Many still believe the initiative constrained liquidity to the sector, accelerating the demise of Silicon Valley Bank and Signature Bank.

Throughout early summer, the House Financial Services Committee stood nearly alone globally as the Republican-led House of Representatives tried to craft a more friendly, predictable policy environment in part to ensure that the center of gravity for blockchain-based intermediation did not shift abroad:

Data: BCMstrategy, Inc.

During the last week of July, the House Financial Services Committee passed seven pieces of legislation designed to facilitate stablecoin regulation at the state level while prohibiting the Federal Reserve from taking action.

Less than two weeks later, PayPal (a state-regulated money transmitter, not a bank subject to Federal Reserve supervision) announced plans to launch a dollar-based stablecoin (August 7) and the Federal Reserve announced a friendly framework for firms to issue “dollar tokens” (August 8).

THE FED’S NEW DOLLAR TOKEN POLICY

Specifically, the Federal Reserve now has a formal “nonobjection process” regarding stablecoin issuance by banks. Federal Reserve supervisors will approve bank applications to “use distributed ledger technology or similar technologies to conduct payments activities as principal, including by issuing, holding, or transacting in dollar tokens.” It is a stunning shift in stance compared to the January and February statements.

Preconditions exist to qualify for the nonobjection process. Authorization hinges on the bank being able to show implementation of appropriate, specific, and familiar risk management protocols. The most important gateway condition involves familiar “know your customer” rules to insulate the bank from unwittingly facilitating illicit transactions.

The Federal Reserve in parallel created a new oversight framework designed to supervise “novel activities” by banks. Specifically, the new supervisory framework “will focus on novel activities related to crypto-assets, distributed ledger technology (DLT), and complex, technology-driven partnerships with nonbanks to deliver financial services to customers.” The initiative reflects the Fed’s own stunning admission earlier this year that its supervisors had not fully understood Silicon Valley Bank’s business model.

The new pair of policies drew criticism from the House Financial Services Committee on the grounds that they undermine the legislation passed by the Committee at the end of July. Members of Congress assert that the new standards “provide the Fed with additional tools to deny crypto-asset related activities…(and) will ultimately lead to a de facto prohibition on banks engaging with the digital asset ecosystem,“ particularly with respect to public, permissionless blockchains. Legal challenges may also be brewing, as the Members of Congress object to the fact that the new policy was implemented without the required notice of comment in advance of a rulemaking.

THREE REASONS WHY IT MATTERS

Many may view the Congressional/Federal Reserve drama as yet another example of petty partisan political bickering in the United States. This would be a mistake. The landscape for cross-border payments and reserve currency dynamics are shifting before our eyes. It matters for three important reasons.

1. The Future of Banking is on the Line (and on the Blockchain)

The most recent Federal Reserve survey data (Economic Well-being of US Households, 2022) indicates that at least 12% of the U.S. population currently holds cryptocurrency. Coinbase data from February 2023 estimates that cryptocurrency ownership rates are nearly double (20%) the Fed’s estimates despite the frauds and insolvencies in the sector last year. Most experts expect usage rates to increase.

In other words: creating hurdles for bank stablecoin issuance would push a large and growing amount of intermediation business outside of the regulated banking sector.

Banks would lose the capacity to compete for customer business at a point in time when deposit outflows continue to increase. A growing number of consumers may choose to hold uninusured deposit-like balances at money transmitters like PayPal rather that at commercial banks. The amounts are not small. As House Financial Services Committee Ranking Member Waters noted in her statement on the PayPal stablecoin, PayPal has 435 million customers globally, which “exceeds the number of online accounts at all of the megabanks combined,” potentially raising both consumer protections and financial stability concerns in her view.

If the Federal Reserve has any hope of exerting influence and control over the digital dollar market, it has every incentive to accelerate the capacity for commercial banks to compete with state-regulated money transmitters like PayPal. Creating roadblocks for banks in this space effectively cedes important intermediation businesses to non-banks.

2. Global Role of the USD, Retail Edition

The stablecoin market currently is a de facto dollar token market. The overwhelming majority of stablecoins are tied to the US dollar.

Globally, consumers interested in experimenting with cryptocurrency issuance in a cautious manner choose coins backed 1:1 with the US Dollar. It is not clear what percentage of these users also seek access to the US dollar for a range of illicit or inappropriate uses. But this is true also for the cash version of the currency.

The new PayPal stablecoin (the PYUSD) will create a mechanism to convert ANY cryptocurrency into dollar tokens redeemable for US dollars.

In other words: retail users around the world continue to see the US dollar as a safe haven relative to their national currencies. PayPal will meet these consumers where they are and accelerate their access to US dollars in digital format.

Permitting US banks to issue their own dollar tokens would further embed reliance on the USD within the formal banking system. Some have recently also suggested in a WSJ opinion piece that expanded access to dollar-denominated stablecoins would solidify the USD’s global reserve currency status for another generation.

Whether continued retail reliance on an electronic dollar token occurs naturally or though legislative design, the Federal Reserve has every incentive to encourage US banks to issue stablecoins. Constraining retail access to the US dollar will create incentives for retail users to rely on non-dollar digital currencies…. like the forthcoming digital euro.

3. Global Role of the Dollar – Geopolitical Competition

History tells us that reserve currencies neither go quietly into the good night nor do the transitions occur slowly. The most recent shift occurred 100 years ago from the pound sterling to the US dollar. Recent research from eminent academics like Barry Eichengreen and Niall Ferguson as well as older books focused on sterling and the derivatives markets among others have chronicled how major geopolitical dislocations trigger volatility shifts in market support for the prevailing reserve currencies of their day.

Resistance to dollar dominance did not begin with Satoshi, BitCoin, and the Great Financial Crisis. Nor did it begin with the post 9-11 weaponization of the currency, much less the periodic debt ceiling dramas. In fact, resistance to dollar dominance began in France in the 1960s. Despite all the complaints about the US dollar’s dominance, the absence of realistic alternatives has largely relegated the complaints to idle talk.

Distributed ledgers change everything.

The proliferation of privately issued payment tokens and sovereign issued central bank digital currencies potentially create multiple alternatives to the US dollar that are immediately accessible globally. No individual currency needs to replace the US dollar for the US dollar to lose its role as the main reserve currency.

This is NOT a theoretical suggestion.

During the third week of August, researchers from the European Central Bank, the Hong Kong Monetary Authority, ASEAN + 3 (South Korea, Japan, China) and the Bank of Finland, gathered in Hong Kong to discuss the future of the international monetary system. It is not clear whether the Federal Reserve was present. Hong Kong Monetary Authority Chief Executive Yue expressly placed the reserve currency competition dynamic in sharp relief:

“Currently, the international monetary system is predominantly a US dollar-based system, and the euro is mainly playing a regional role. This system has been the foundation of globalisation of the world economy for several decades. However, with increasing geoeconomic fragmentation, to what extent will the world also move towards a more multipolar monetary system with different currency blocs?...Looking further ahead, a more pertinent question would be: How will the advancements of wholesale CBDCs speed up the use of local currencies in cross-border payments, thereby reducing the use of major reserve currencies?”

Nor is it an academic suggestion. The European Central Bank is widely expected to announce its plans to take the next step towards launching a digital euro this autumn. Policymakers have been publicly opining all year about the possibility that a digital euro could position the common currency for a larger global role.

A shift away from the US dollar as a global reserve currency will impose costs on the United States over time. It could easily increase prices as imports incorporate exchange rate risks and as the cost of transaction fees are passed on to end users. Political science and history suggest strongly that multipolar systems in general tend to be less stable than bipolar ones, with increased risks of volatility as different poles in the system compete with each other for advantage.

If the Fed values its role as steward of the U.S. dollar’s global role and its ability to provide financial stability when the situation arises, policymakers really have no other choice but to embrace dollar tokens and stablecoins. Between January 2023 and August 2023, its shift of stance on paper implicitly reflects this realization. Ironically, they agree with their foes on Capitol Hill on this point.

Failure to find consensus and continued public bickering on the road towards tokenization risks creating strategic opportunities for private and sovereign competitors to the US dollar. The next 18 months promise to be as interesting as the last 18 months.

Barbara C. Matthews is a non-resident Senior Fellow with the Atlantic Council. She is also the Founder and CEO of BCMstrategy, Inc., a data and technology company that measures public policy risks using patented technology. She was the first U.S. Treasury Attache to the European Union with the Senate-confirmed diplomatic rank of Minister-Counselor. She also served as Senior Counsel to the House Financial Services Committee. The views in this essay reflect her personal opinion. As a data and technology company, the BCMstrategy, Inc. team and board do not provide analysis or opinions regarding public policy developments.